where's my unemployment tax refund

Unemployment Compensation - This box includes the dollar amount paid in benefits to you. In the latest batch of refunds announced in November however the average was 1189.

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

The IRS has sent 87 million unemployment compensation refunds so far.

. Unemployment Refund Tracker Unemployment Insurance TaxUni. The unemployment benefits were given to workers whod been laid off as well as self. Enter your Social Security number.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Tax Exemptions for Unemployment Benefits. If you did NOT PAY taxes on your unemployment and received your full 60000 weekly UI payments you will not be getting the unemployment refund.

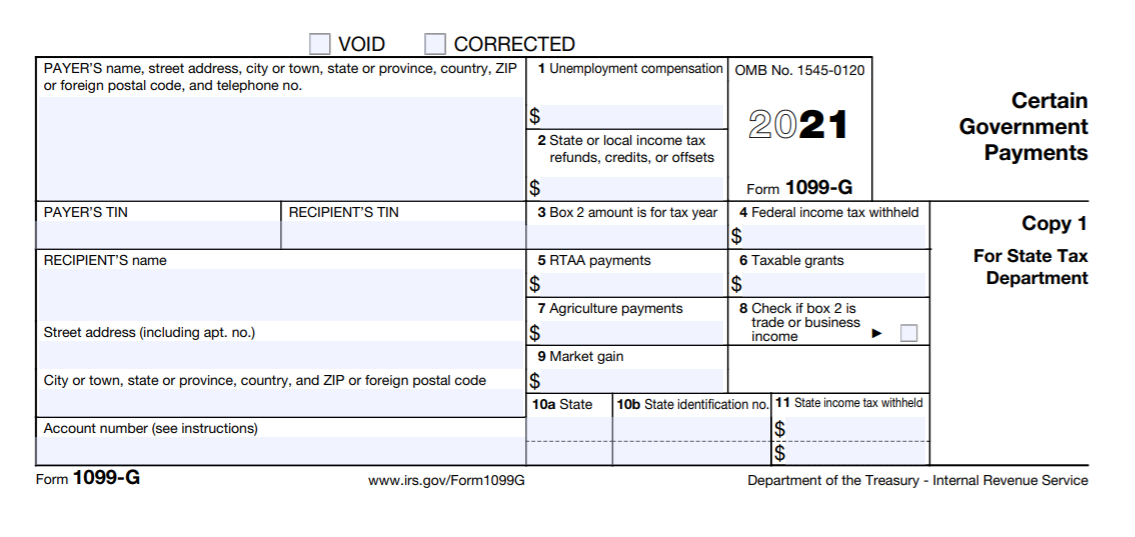

The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in. Paper Return Delays If you filed on paper it may take 6 months or more to process your. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Especially for those who did not. Viewing the details of your IRS account.

Using the IRSs Wheres My Refund feature. Choose the form you filed from the drop-down menu. This is the fourth round of refunds related to the unemployment compensation.

Enter the amount of the New York State refund you requested. Check The Refund Status Through Your Online Tax Account. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

The first 10200 of unemployment benefits will not be taxable for those who earned 150000 or less in 2020. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

The information on the 1099-G tax form is provided as follows. The unemployment tax refund is only for those filing individually. Get information about tax refunds and track the status of your e-file or paper tax return.

Where Do I Enter My 1099 G Form On Turbotax

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Dor Unemployment Compensation State Taxes

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Updates Where S My Refund Signals Az

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

The Ui Tax Refund On My Transcript 1 229 23 Is Less Then The Unemployment Taxes Paid 2 606 Shown On My 1099g Is There Any Reason For This R Irs

How To Receive Your Unemployment Tax Refund As Usa

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Waiting For Your Tax Refund Here S How To Track The Status Of Your Payment Mlive Com

What To Know About Irs Unemployment Refunds

New York Unemployment Where To Find Your Tax Form For 2020

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

:max_bytes(150000):strip_icc()/WhereIsYourTaxRefund-85e9107ea88049bab6caf00d2d62dc71.png)